✦ SHIPPING • DUTIES • DELIVERY

Simple. Transparent. Reliable: We ship worldwide.

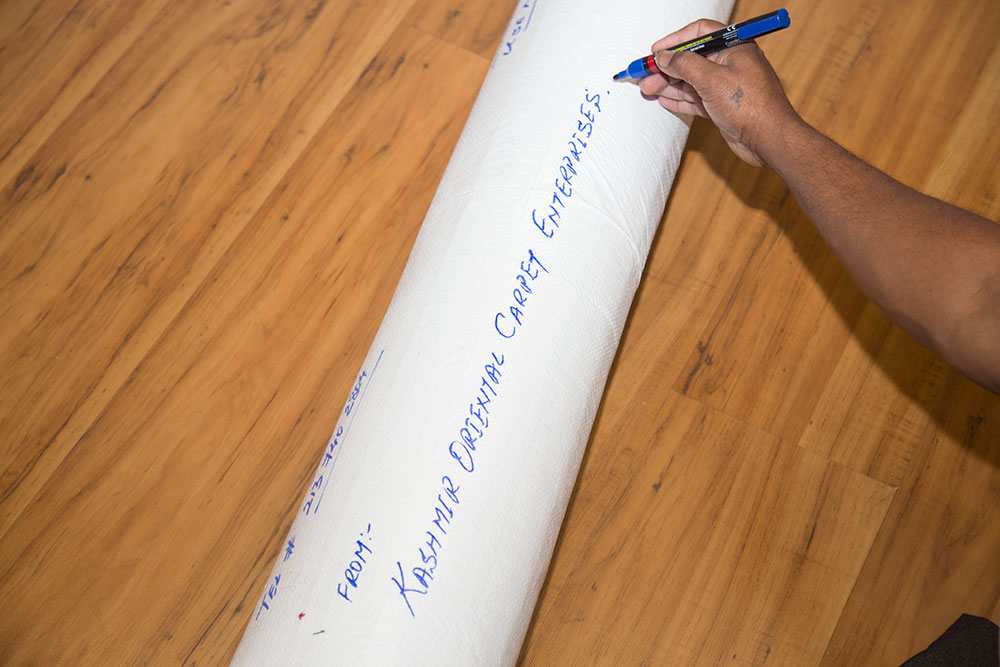

No-Profit Shipping

We follow a strict “No Profit No Loss” shipping policy: you pay exactly what we pay.

Before ordering, learn how to verify true Kashmiri craftsmanship at Original Kashmiri Carpets.

Shipping costs vary by destination and courier and are always clearly displayed on your invoice or at checkout.

Waterproof, tamper-proof packaging is included at no extra cost.

Transit Insurance — On Us

Every shipment is fully insured for its entire invoice value from pickup in Mumbai to delivery at your doorstep at no additional charge.

This coverage applies to all orders, regardless of size or value.

Typical Transit Times

International deliveries from Mumbai via FedEx usually take 5 to 7 business days, depending on the destination and local customs clearance.

Please note: this estimate excludes customs processing or extraordinary delays caused by weather, strikes, or geopolitical disruptions.

✦ CUSTOMS, DUTIES & TAXES: WHAT TO EXPECT

Import duties, taxes, and local fees are determined by each country’s customs regulations and are the buyer’s responsibility.

Below is an overview of key regions and what you can expect when importing from India.

United Kingdom

The UK–India trade agreement (2025) reduces or removes tariffs on many goods. However, duty depends on the specific HS code and whether the correct origin documents are provided. Always confirm before assuming zero duty.

European Union

The EU applies VAT on all imports, regardless of value. Couriers such as FedEx generally advance VAT at import and bill the consignee afterward.

United States

Customs charges such as the Merchandise Processing Fee (MPF) apply. Additional duties may be levied depending on classification. Couriers often add a small handling fee. MPF thresholds are updated periodically; please check the current CBP schedules.

Singapore

Singapore levies zero import duty on most goods, including carpets. However, a 9% Goods & Services Tax (GST) applies on all imports, calculated on the CIF (Cost + Insurance + Freight) value.

Even if duty-free, GST is charged on the total landed cost.

United Arab Emirates (UAE)

Most imports attract a 5% customs duty on the CIF value. Higher rates apply for alcohol, tobacco, etc.

Goods entering Free Trade Zones (FTZs) may follow alternate rules depending on how they are distributed or re-exported.

Hong Kong

Hong Kong operates as a free-port economy with virtually no import tariffs. Carpets and textiles typically enter duty-free, and there is no VAT or GST. Only standard customs documentation is required.

Australia

Australia generally applies a 5% import duty unless a trade agreement or concession provides relief.

Carpets (HS Chapter 57) are subject to specific classifications; many may qualify for reduced or zero duty under trade agreements.

New Zealand

Most imports are duty-free. Certain textiles may attract 5% or 10% duty.

GST of 15% is charged on imports valued above NZ $1,000.

Customs usually does not collect GST or duty for shipments below this threshold (except for alcohol or tobacco).

⸻

✦ HOW CHARGES ARE COLLECTED

Couriers such as FedEx will contact the consignee regarding import duties, VAT, or GST.

If these are advanced on your behalf, the courier will invoice you for reimbursement.

If a shipment is refused due to non-payment, it may be returned to us. In such cases, return freight, duties, and re-shipping costs will be billed to the buyer. Refunds cannot be issued for such returns.

⸻

✦ PAPERWORK & TRADE PREFERENCES

Whenever eligible, we include origin certificates (such as GSP, FTA, or other trade documents) to help reduce or eliminate import duties.

To claim these preferential rates, importers must present the certificates to their local customs office.

If you share your destination country and product details or HS code, we will confirm the likely duty treatment and provide the proper documentation before dispatch.

⸻

✦ SMALL PRINT, CLEARLY SAID

• Shipping charges apply to all orders, including custom rugs, samples, strike-offs, yarns, shawls, and scarves.

• We are not responsible for customs decisions or any local taxes imposed by authorities.

• Once dispatched, FedEx (or your chosen courier) is responsible for safe and timely delivery.

• We cannot be held liable for delays due to customs, force majeure, or incorrect consignee details.

⸻

✦ RECENT U.S. TARIFF UPDATES

As of 2025, the United States has introduced new tariffs on certain textile and carpet imports under updated trade measures (including Section 301 provisions).

These changes may affect specific categories of handmade rugs depending on materials, weave, or classification.

For full details, please read our detailed breakdown: U.S. Tariff Update on Carpets & Textiles

⸻

✦ QUICK FAQ

Do I pay duties or taxes?

Yes. Import duties, VAT/GST, and customs fees vary by country. They depend on local rules and any trade agreements in effect.

How long will delivery take?

Usually 5 to 7 business days via FedEx from Mumbai (excluding customs clearance).

Is the shipment insured?

Absolutely. Every shipment is fully insured for its full invoice value at no cost to you.

What documents are included?

We provide eligible trade certificates (GSP, FTA, etc.) to help minimize or eliminate import duties.

⸻

✦ DUTY & IMPORT CHECKLIST: WHAT TO EXPECT

Step 1: Identify your tariff code

Check your country’s customs or tariff lookup for the correct HS Code of the product.

✅ We provide: Product description and HS Code (if known).

💡 Tip: Most customs websites have an online tariff finder.

Step 2: Check for trade agreements or GSP benefits

Determine whether your country has a Free Trade Agreement (FTA) or Generalized System of Preferences (GSP) benefit with India.

✅ We provide: Applicable origin or preference certificates.

💡 Tip: These must be presented to claim reduced or zero duty.

Step 3: Estimate VAT / GST and courier handling fees

Find out the VAT / GST percentage applicable in your country and whether your courier will charge an advance or handling fee.

✅ We provide: Transparent invoice values and declared shipping cost.

💡 Tip: Couriers often pay VAT in advance and bill you later.

Step 4: Confirm import duties or tariffs

Check if handmade rugs or carpets attract any duty in your country.

✅ We provide: Product classification under HS Chapter 57 and origin details.

💡 Tip: Duty may depend on the material, weave, or tariff subheading.

Step 5: Allow for customs clearance time

Once goods arrive, customs may inspect or hold them for paperwork verification.

✅ We provide: Complete, compliant export documentation.

💡 Tip: Factor in holidays or local inspection delays.

Step 6: Prepare for duty / tax payment

Your courier (e.g., FedEx) will contact you about import charges.

💡 Tip: Keep payment ready to avoid delivery delays.

Step 7: Keep all documentation

Retain your courier invoice, import duty/VAT receipt, and our invoice.

💡 Tip: These are helpful for business accounting or any future imports.